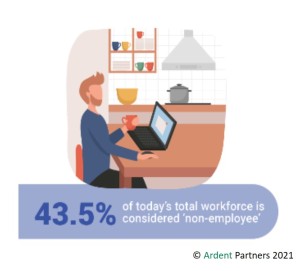

A massive shift is underway in organizational employment practices. In 2021, Ardent Partners’ research AP Metrics that Matter in 2021 eBook, shows that the non-employee workforce has reached a “tipping point” with 43.5% of today’s total workforce considered “non-employee.”

The non-employee workforce, aka ‘Gig Workers’, is clearly on the rise as the graphic above points out. Gig workers are all around us and many of us may think we are dealing with company employees when in fact they are really independent contractors, temporary workers, contract/employment firm workers, etc. Years ago, the non-employee workforce was perceived as an alternative and cost-cutting talent-based strategy to get through tough economic times or a way to expand a company’s workforce when it needed to do so on a temporary basis. While some companies are still utilizing ‘gig’ workers in this fashion, what we have seen over the past 10 – 15 years is an evolution of the contingent workforce from a necessary stop gap measure to one that is planned for and relied on as a source of expertise, knowledge and value in an ever increasing competitive landscape.

What does this have to do with Accounts Payable – Everything. No, I am not talking about organizations leveraging ‘gig’ workers to perform AP work, although that may be happening in some organizations. I am specifically referring to the impact on how AP tracking, managing, and paying non-employee workers. According to Ardent Partners’ AP Metrics that Matter in 2021 eBook, by the end of 2022, 52% of businesses expect to leverage/utilize ePayables technology to assist in the payment of gig workers and independent contractors.

This shift in talent acquisition will result in increased pressure on AP to manage this new and expanding workforce, which translates into an increased number of invoices, 1099 forms, reporting requirements, payment flexibility, and other new considerations. Are you prepared? The shift is happening and AP organizations need to understand the potential implications to their way of working and their workload so they can plan and adapt to the changes occurring around them.

Comments are closed.