The strategic value of AP & Dynamic Discounting in creating high yield, low risk investment opportunities.

In today’s global economy the enterprise faces multiple areas of financial concern, from the Eurozone crisis to slow economic growth and tight credit markets. This makes the job of the corporate treasury a difficult one. Some of their top priorities for 2012 include:

- Establishing the right level of liquidity

- Gaining greater control over the timing of cash outflows

- Establishing highly streamlined and efficient financial operations

- Making the best use of enterprise cash

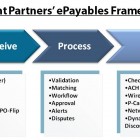

Where and how does AP come into this picture? Well, as AP groups begin automating their processes and gaining (and sharing) real-time access to invoice and payment data, they are in a better position to influence and support the cash management strategies that treasury wishes to implement.

In manual environments, the inefficiency and lack of visibility make it all but impossible to leverage any of the valuable data that lies within AP. Data that can be utilized to support financing programs such as supply chain financing as well as activities that can have a more immediate impact such as capturing early payment discounts.

To hear more on this topic, please join myself and Drew Holfer, Sr. Solutions Marketing Manager of Working Capital & Payment at Ariba on a webinar with Treasury & Risk Management.