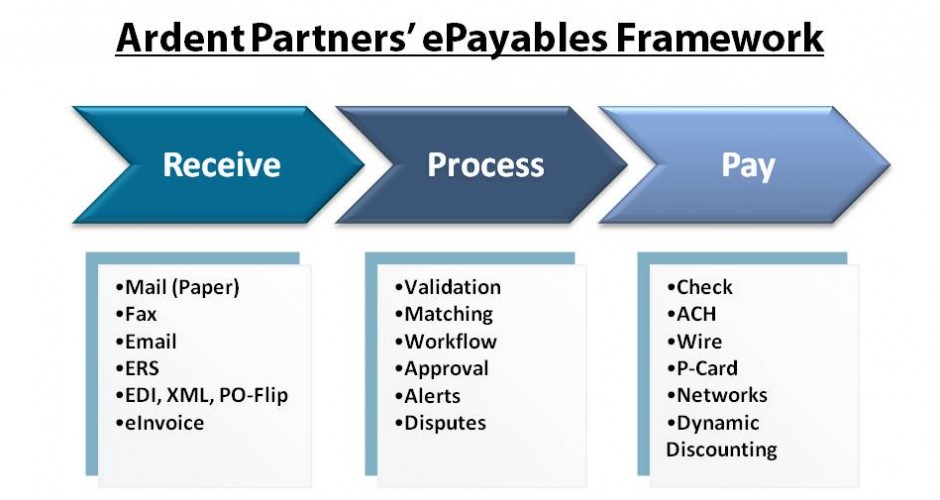

As this is the first article after yesterday’s launch, I thought it best to start off by providing our view of the accounts payable world. At Ardent, we use the term ePayables to describe the various solutions and services that automate all or part of the AP process and in case you were wondering, yes, we do have a framework for it (shown above) – The Ardent Partners ePayables Framework™

The framework looks at the three distinct phases of invoice processing:

Receive – This refers to the manner in which an AP department receives invoices, whether in a manual way through the mail, fax, and email or in a more automated way using scan and capture technology, electronic invoicing or EDI (typically for more strategic suppliers). As this is the first step in the process, the manner in which invoice data is received impacts the speed and ease in which it is processed and paid.

Process – The second phase in the process is where the received invoices are processed, this typically includes:

- Validation – Ensuring that there are no errors or discrepancies and that the correct supplier, amount, price, address, etc are included on the invoice.

- Matching – Ensuring that the items were in fact ordered, that the price is correct and that the items were received, the invoices is typically matched against a PO, GRN (good received note) and/or a contract.

- Approval – If there are no errors or disputes that need to be resolved with the supplier, based on the amount, the type of goods or services or other factors, the invoice is then routed to the appropriate people to be approved.

Pay – The final step once an invoice is validated, matched and approved is the payment. Traditionally, payments have largely been made by paper checks, however more and more enterprises are migrating away from this manual method towards electronic forms of payment. This includes commercial cards, ACH or wire transfers. This part of the process is also where the more sophisticated cash management strategies can be implemented (i.e., dynamic discounting, supply chain finance).

Each of the three phases has various sub-processes, steps, and formats that can vary across enterprises. By utilizing the ePayables Framework and breaking the AP process into smaller, more manageable segments, AP departments will be able to implement greater operational efficiency, enact stronger financial controls, and improve transactional visibility and flexibility.

AP groups should use the ePayables Framework to help establish the current state of operations – “what is happening” – and use it as an opportunity to clearly define their new AP processes – “what should happen.” By developing a clear view into what scope of activities occur within each phase of the Framework and understanding what resources and systems are utilized and what processes are followed, AP departments will be better able to set standard practices and work to develop best practices. They will also be better able to identify the key drivers (and key obstacles) to improving performance. And, they will ultimately be much better able to build a case for investment and transformation.

1 Comment